The Four Most Dangerous Words

The Four Most Dangerous Words...

The late great Sir John Marks Templeton - of Templeton Growth Fund fame - once quipped that the four most dangerous words to an investor were: "this time is different." Many market strategists warn that the sky is falling or that the investing principles that worked in the past no longer hold true in this new world of artificial intelligence and political unrest. The truth is that the facts and situations are (slightly) different from anything in the near or distant past. The rest of the story is that the human reaction, however, is the same and reasonably predictable. Read MORE!

Mean Reversion Works

Source: Canterbury Investment Management

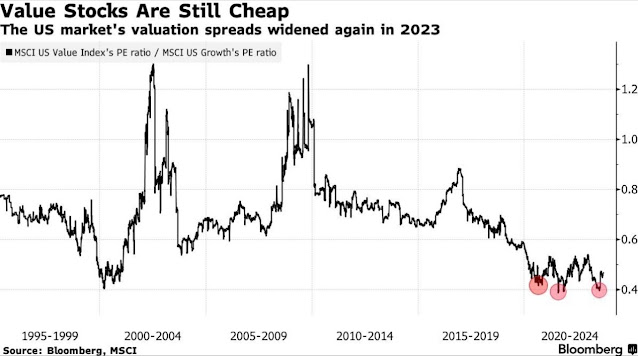

The chart shown above compares the history of value stocks to growth stocks over time. The market dance that occurs over time is evidenced by the convergence and divergence between the orange and blue lines over the past 30 years. The currently wide gap between the performance of value stocks and growth stocks may signify a change in the market tides that could bring significant benefits to value investors. You may know that JQR Capital employs a value approach to our stock selection process. Learn more HERE.

This second chart shows how the performance of small company stocks compares to that of large company stocks over a very long period of time. It is helpful to remember that EVERY large company started out as a small company...

A closer look at the recent performance indicates that the long term effect may have taken a pause and that a reversion to the mean may be in the cards.

Source: Federal Reserve Economic Data

One way of thinking about that physical spring in financial terms is to use a valuation metric. One popular metric is the price to earnings (PE) ratio. The PE ratio is simply the stock price divided by the earnings per share (EPS) from the last 12 months. It is one of a handful of valuation metrics used to guide investment decisions for value managers. The chart below shows that the gap between value stocks and growth stocks has never been wider for this amount of time over the past 25+ years. JQR Capital uses a value approach to our security selection process and we expect the "spring" to contract as part of the mean reversion process.

Source: Bloomberg, MSCI

In the short run, the market is a voting machine, but in the long run it is a weighing machine. - Benjamin Graham

...This Time Is Different

It is very easy for us humans to get lost in the weeds of seeing only the recent past. Jumping into a helicopter allows us to get the view from cruising altitude and think long term. It is well worth the trip to look at the long term when the short term is bringing us a case of insomnia!

Past performance is no guarantee of future results. Any investment involves some amount of risk and may not be suitable for all — or any — individuals. You should consult with your investment advisor before acting on this — or any — financial information.

.png)

.png)

Comments

Post a Comment